Many Americans are hearing about a possible $2,000 direct deposit arriving in February 2026. Naturally, people want clear answers. Is it a new stimulus payment? Who qualifies? And when will the money arrive? The important thing to understand is that the $2,000 amount being discussed is not a newly approved universal stimulus check. In most situations, it refers to regular federal payments such as tax refunds or benefit deposits that may total around $2,000 depending on individual eligibility. Understanding where this number comes from helps separate facts from online rumors.

What Is the $2,000 Direct Deposit?

The $2,000 figure is commonly linked to federal tax refunds or certain monthly benefit payments. Many taxpayers receive refunds close to or above $2,000 depending on income, tax withholding, and refundable credits. Others receiving Social Security retirement benefits or SSDI may have monthly payments near this amount based on their lifetime earnings and recent cost-of-living adjustments. There is currently no officially announced nationwide $2,000 stimulus payment for February 2026. Any payment amount depends entirely on the specific program and personal qualification. Common federal payments that may reach around $2,000 include:

- IRS income tax refunds

- Social Security retirement benefits

- Social Security Disability Insurance (SSDI)

- Veterans benefits in certain cases

Supplemental Security Income (SSI) payments are generally lower than $2,000 for individuals, though combined household benefits may vary.

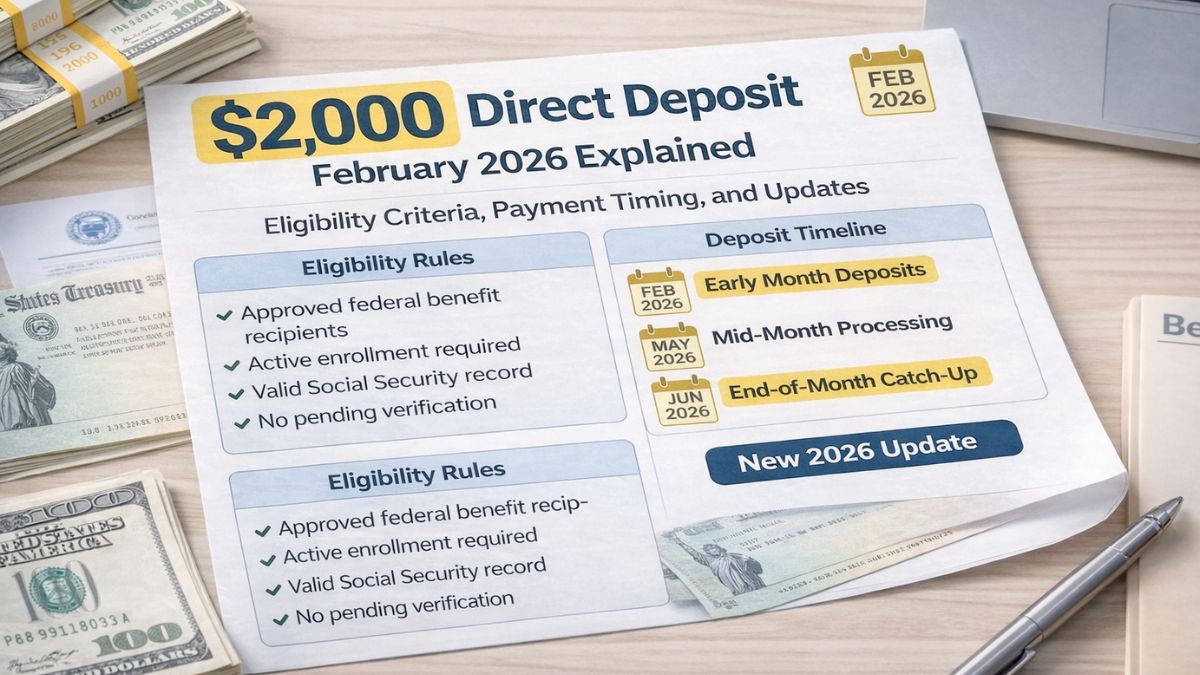

Who Is Eligible?

Eligibility depends on the type of payment involved. For tax refunds, eligibility is based on your 2025 income, filing status, credits claimed, and how much tax was withheld from your paycheck. Taxpayers who qualify for credits such as the Earned Income Tax Credit or Child Tax Credit may receive larger refunds. For Social Security retirement benefits, eligibility depends on work history and earned credits. SSDI requires both a qualifying disability and sufficient work credits. SSI is designed for individuals with limited income and assets. Veterans benefits depend on military service history and disability or pension qualifications. If you are unsure whether you qualify for a payment, the safest option is to review your account directly through official IRS or Social Security online portals.

When Will Payments Arrive?

Payment timing varies by program. IRS tax refunds typically begin processing once filing season opens in late January. Taxpayers who file electronically and select direct deposit often receive refunds within about 21 days after their return is accepted. Early filers may see deposits in February 2026. Social Security retirement and SSDI payments follow a structured schedule based on birth date:

- Birth dates from the 1st to the 10th are usually paid on the second Wednesday of the month.

- Birth dates from the 11th to the 20th are typically paid on the third Wednesday.

- Birth dates from the 21st to the 31st are paid on the fourth Wednesday.

SSI payments are generally issued on the first of the month unless that date falls on a weekend or holiday. Direct deposit remains the fastest and most secure way to receive funds. Paper checks may take longer due to mailing time.

Important Updates to Keep in Mind

As of now, there is no confirmed standalone $2,000 federal stimulus payment scheduled for February 2026. Most online discussions appear to refer to regular tax refunds or existing federal benefit programs. If you expect a payment, make sure your banking information is current and accurate. Filing taxes early and reviewing benefit records can help prevent delays. It is also important to remain cautious. Scammers often use trending payment rumors to request personal information. Federal agencies do not ask for sensitive details through unsolicited emails, calls, or text messages.

Final Takeaway

Not everyone will receive a $2,000 direct deposit in February 2026. The amount depends entirely on individual eligibility for tax refunds or federal benefits. Some people may receive around that amount, others may receive more or less, and some may not receive any payment at all. Checking official government accounts is the best way to confirm accurate information.

Disclaimer

This article is for general informational purposes only and does not provide tax, legal, or financial advice. Payment amounts, eligibility criteria, and timelines vary based on individual circumstances and official government rules. Readers should verify details through official IRS, SSA, or VA resources and consult qualified professionals for personalized guidance.